Advance Child Tax Credit Payments Begin July 15

Here's What You Need to Know

The American Rescue Plan Act of 2021, made changes to the Child Tax Credit for 2021. The Child Tax Credit (CTC) is a cre…

Are Scammers Preying on Your Economic Impact Payment?

In the midst of the current COVID-19 pandemic, it's also tax season. And while you're waiting to hear about your economic impact payment, criminals …

Don't Fall for Tax Time Scams

Scams occur all year round but some types of scams peak during tax season. The IRS publishes a list of the worst of the tax scams each year called the…

Don't Get Caught by This Fake IRS Tax Form Scam

There is a new scam that is sending people fake tax forms related to the Affordable Care Act. It may come by email or by mail and indicates that the r…

End of the Year Tax Saving Tips

The end of the year is fast approaching and many people are focusing on the holidays. But you should take a bit of time to ensure that you are taking …

Financial Planning for the Year Ahead

Tips for wrapping up this year and getting a jump start on the next.

The end of the year is fast approaching and many people are thinking of things o…

Haven't Filed Your Taxes Yet? Watch Out for These Scams

The IRS has announced their "Dirty Dozen" tax scams for 2019. These scams can occur anytime during the year but tend to peak during tax season. Here a…

How Long Should You Keep Your Tax Records?

Once you file your income tax, you aren't quite done. You need to finalize your records. This report looks at the records you need to keep and how lon…

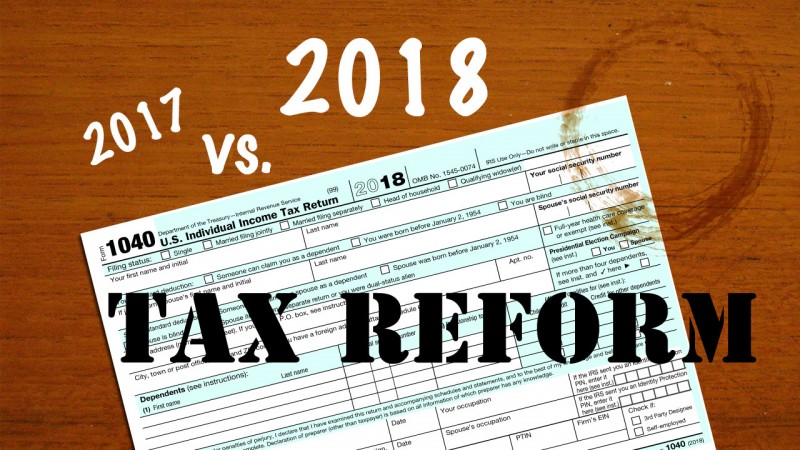

How Tax Reform Impacts Your 2018 Federal Income Taxes

The Tax Cuts and Job Acts bill that was enacted in December 2017 will probably impact your 2018 Federal income tax return. The bill made sweeping chan…

How to Choose a Tax Preparer?

Doing your taxes can be complicated, but so can hiring a tax preparer. Arm yourself with the right information!

IRS Extends Filing Deadline. Should You Wait?

The IRS has extended the federal income tax filing due date to July 15, 2020. This applies to all taxpayers. You don't have to apply for this extensio…

It's Tax Time! Check Out These Tips

It's tax time. This year your federal income tax return for 2019 is due on Wednesday April 15, 2020. The following tips can help you with filing your …

July 15 Tax-Filing Deadline is Fast Approaching. Have You Filed Yet?

If you haven't filed your 2019 federal income taxes, you will need to file them by July 15 or request an extension. The IRS is recommending that you u…

Taxed on Your Payment App Income?

Tax rules are changing… If you’re using your payment app for your business, you will have to start paying taxes on this income soon. Dig in now.…

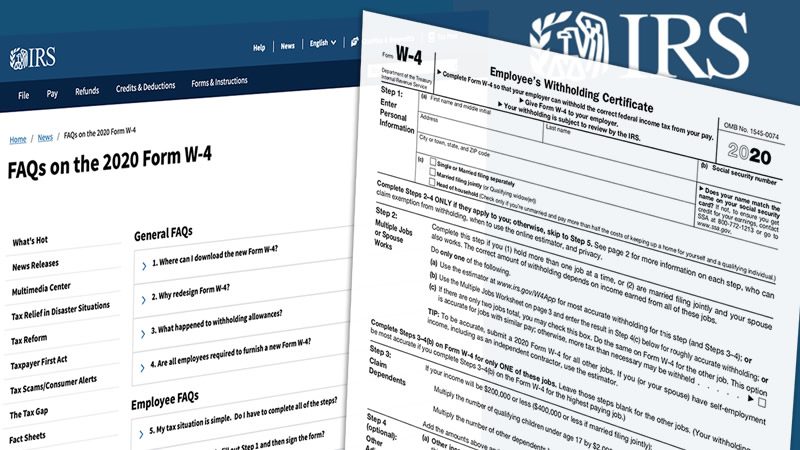

There's a New W-4 for 2020. Here's What You Need to Know.

The W-4 form was redesigned to reflect the changes in the 2017 tax reform law which reduced tax rates, doubled the standard deduction, and increased t…

Tips and Tools to Help with Retirement Planning

Have you started planning for retirement? Whether retirement is just a few years away or decades, these tips and tools can help you keep your plan on …

Young People and Taxes!

Regardless of what job or career you may have during your life and what country you may live in—the U.S. or abroad—you're going to be paying taxes…