Protect Your Privacy and Reduce the Data Collected About You with These Tips

Given the advanced search tools and skills of these brokers, it may seem that protecting your privacy is a lost cause. It's not.

Even Fraudsters Have Resolutions

Scammers are busy, too. They resolve to rake in loads of cash by selling fast weight loss with minimal effort.

Beware of Utility Scams

Utility scams can occur any time of the year but may increase during periods of very hot or cold weather and after natural disasters.

Life Hack: Identifying Spam Accounts on Social Media

When you're on social media platforms like Twitter, Facebook, Instagram, or even Pinterest, you never really know for sure who or what you're dealing.

Robocalls. What Is Being Done to Stop Them?

Any call with a recorded or artificial voice message is a robocall. While some of these calls are legitimate, many, perhaps most, are not.

Chip Shortages May Impact You in More Ways Than You Think

The shortage of semiconductor chips has been in the news frequently this year. Smartphones, computers, and other digital devices aren't the only products that use these chips.

Advance Child Tax Credit Payments Begin July 15

The Child Tax Credit (CTC) is a credit for individuals who claim a child as a dependent on their federal tax return as long as the child meets certain conditions.

Shopping for the Holidays? Watch Out for Scams Online and Off!

Scammers are always trying to find ways to part you from your money and personal information. During this time of the year, they up their game to take advantage of the increased hustle and bustle.

Scammed with Your Payment App

Say you're selling something—online or offline—and you get paid by a stranger. He pays you via payment app—think Venmo, Zelle, Square Cash and the like—and the money shows up in your app account instantly.

Credit Score Apps. Are They Worth the Cost?

Credit scores are important to our financial life. These scores are used to determine if you are a good risk for credit cards, car loans, and mortgages and what rate you will pay.

What You Need to Know About Amazon Sidewalk

If you have an Amazon Echo, Tile, or Ring device, read on. Amazon turned on their Sidewalk service for Echo devices on June 8th and will turn on Tile devices on June 14th.

Can Making Mistakes at Work Be Good…?

Knowing that's it's okay to make mistakes is not only good for your own development, but also for the organization you work for. It leads to more innovative capacity and creativity.

Keeping Your Payment Apps (and Money) Safe

The way we pay has steadily changed over the years. Carrying cash and using plastic cards are becoming an old concept as we shift towards apps and other contactless payment options.

Renting? Do You Know Your Tenant Score?

These reports are generated by companies specializing in consumer reporting and many include proprietary scores that rate the possible tenant.

Vishing Is On The Rise. Don't Get Caught!

Vishing attacks are voice phishing attacks. By using the phone, scammers can use emotion and build trust in order to trick their victims.

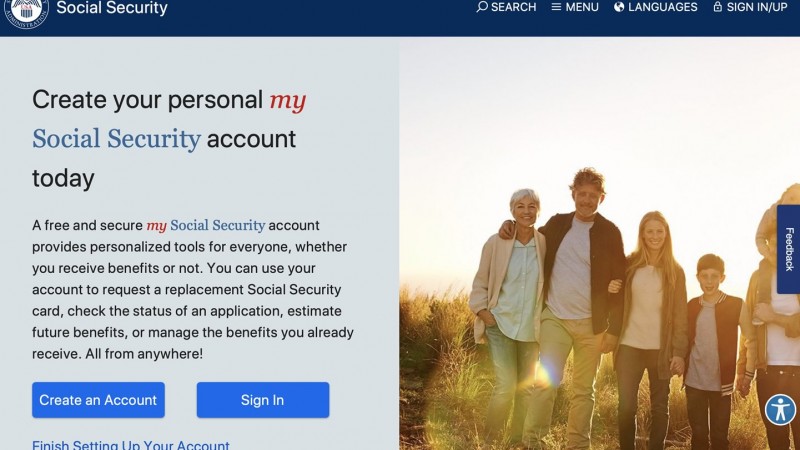

Tips and Tools to Help with Retirement Planning

Have you started planning for retirement? Whether retirement is just a few years away or decades, these tips and tools can help you keep your plan on track.

Job Hunting? Avoid Getting Scammed with These Tips

Job hunting is stressful enough without having to worry about getting caught by scammers. Instead of offering you a job, scammers want your money and personal information.

What You Need to Know About the T-Mobile Data Breach

On August 16, 2021 T-Mobile announced that it was investigating a possible data breach. On August 17th, the company confirmed that data was stolen.

Looking for Tips to Manage Your Debt?

Debt is costly. The longer it takes to pay off debt, the more money you pay in interest. These tips can help you start taking control of debt.

Learning How to Invest, Wisely and Safely

With saving account interest rates at all-time lows (2021 national average at 0.06%), more and more people are looking to invest their money instead.

Pros and Cons of Money-Saving Apps and Browser Extensions for Online Shopping

There are many browser extensions and apps that want to help you save money when shopping online. Some may find discounts, coupons, best prices, or cash-back rewards.